I studied Finance in college, with an emphasis on investments.

I studied Finance in college, with an emphasis on investments.

But I am not a professional and certainly not qualified to give specific investment advice.

I have also only made one investment in a cannabis business (I’ll disclose which one further down).

I point all of this out to make sure you understand that I am no expert.

And I am not going to give you advice on specific investments.

Instead, I will help you get started investing in cannabis-related businesses. I will teach you what you need to know to navigate the world of cannabis investments.

Contents

- 1 Getting Started With Cannabis Investment

- 2 My Only Cannabis Investment

- 3 Cannabis Investments: Final Thoughts

Getting Started With Cannabis Investment

If you are thinking about making some investments in marijuana businesses, you will want to first follow the standard advice for investing in any business. Then you need to take into consideration some risks specific to cannabis investments.

Do Your Homework

The first step before entering the world of cannabis investments is to see if it is right for you. The ability to purchase cannabis stocks doesn’t necessarily mean you should. It is important to evaluate your investment goals, existing portfolio, and risk tolerance before making a decision.

Know The Risks Of Investing In This Business

Understand that there are pros and cons to investing in this market. While the cannabis industry does attract money, it also has thieves and scammers. Sometimes, short sellers short the stocks en masse, causing them to skyrocket. Regular investors then lose money when the stock prices drop back down to earth.

Cannabis businesses can also fail when federal, local, and state laws come into play. This industry has a rapidly changing legal landscape and laws are not standard across the board. Government legislation can still change and sometimes the government even backtracks on earlier laws.

There is no guarantee of success and startups and even big businesses can fail. As an investor, it is important to know these risks. You should also understand that pricing and taxation can change and there is a risk of dilution as companies try to meet demand.

Explore Different Cannabis Businesses

Once you are sure that a cannabis investment is right for you, you need to understand the different types of cannabis businesses.

Myriad businesses are operating in the cannabis industry, including agriculture technology, ancillary businesses, biotechnology, cultivation and retail, organic farms, holding companies, hemp product businesses, etc. Do your homework and choose the right type to invest in.

Know The Criteria For Choosing A Cannabis Investment

Before investing, carefully review all of the company’s disclosure documents, including its prospectus, listing statements, and offering memoranda. These will provide information about the business. Read all of these documents carefully and, if needed, seek the advice of a financial advisor.

Below are some criteria you can use as general guidelines when considering an investment in the cannabis business:

- The business is already profitable and posting consistent profit growth.

- It has a great reputation.

- It has a great management team.

- It has a positive money flow index (MFI).

- It has a comparatively low P/E (price-to-earnings) ratio (when compared to similar businesses and to its historical average).

- For growing companies, look for specific metrics like the total per-gram cost of producing cannabis.

Note that the criteria you use to decide on buying a stock today could change significantly in just a few months, due to changing laws in the industry.

Compare Companies

You must also compare revenue growth between two or more businesses before investing. Once you find a good company to invest in, try to understand its growth strategy and competitive position.

As mentioned earlier, read the company’s financial statements. Assess how many warrants and convertible securities the company has issued. If this number (percentage) is high, it implies that the stock is meaningfully diluted, causing the share prices to drop.

Fundamentally, cannabis and hemp edibles are based on food science. If a company cannot explain what it is doing in a way you can understand, they are probably lying.

Assess every investment and make sure the people are legitimate. They should have a good track record and should be committed to doing what they do.

Buying And Selling Cannabis Stocks Or ETFs: Open A Brokerage Account

You need to open a brokerage account on one of the trading websites or apps. You can invest directly in cannabis companies, focusing on specific subsectors, and track the share price movements of individual stocks. Alternatively, you can go for cannabis ETFs (exchange-traded funds).

You trade these just like stocks but they hold assets in multiple industry companies and offer diversified exposure. This helps reduce your risk compared to individual stock investments. Here are some top ETFs and stocks:

- ETFMG Alternative Harvest ETF

- Horizons Marijuana Life Sciences ETF

- Curaleaf Holdings

- Trulieve Cannabis

- Green Thumb Industries

- Cresco Labs

- Verano Holdings Corp

Note that I do not endorse any of these companies. I have not done any research on them and do not know if they are good investments. Please do your research before investing in any of them.

It is also important to understand that concentrating too much of your investment portfolio on a single marijuana stock or ETF isn’t wise. Spread your money around, in order to reduce overall risk.

Minimizing Risks And Maximizing Gains

Of course, this is always the goal when investing. Here are the steps to take to minimize your risk and maximize your gains.

Start Small

Start with a small investment in one of the marijuana stocks above and add more as the market and company grow. Your risk will be low if the company does well, and if it doesn’t, you can always reassess, take a step back, and reconsider the investment.

Monitor The Ever-Changing Industry

While you need to always keep a long-term view when it comes to marijuana investments, it is also important to stay abreast of the ever-changing dynamics in the industry. As mentioned above, the criteria you used to buy stocks last month could drastically change this month based on the current dynamics.

Talk To People You Can Trust

You can get invaluable insights by talking to people in this field. But make sure they are people you trust. Networking with trustworthy people within the industry can provide you with knowledge about the right stocks to buy.

Don’t Wait On The Sidelines For Too Long

Waiting too long can make you miss a significant opportunity. Some investors plan to wait until the federal prohibition ends, but by then, large institutional investors might move in, causing you to miss out.

There is a saying (not sure who said it): time in the market beats timing the market. I probably butchered that, but basically, don’t try to time the market. The way you make money is to be invested long-term, with a diversified portfolio of stocks and other investments.

When buying or trading cannabis stocks, avoid these ten mistakes:

- Lack of research: failing to thoroughly research the company and industry trends

- Ignoring regulations: overlooking legal and regulatory changes that impact the market

- Over-concentration: investing too heavily in one stock or sector, thereby increasing risk

- Chasing hype: following trends blindly without evaluating the company’s fundamentals

- Neglecting diversification: not diversifying your portfolio, which again increases your risk

- Keeping unrealistic expectations: expecting quick profits without understanding market volatility

- Ignoring financial health: overlooking a company’s balance sheet, revenue, and earnings

- Disregarding competition: not considering the competitive landscape and potential market share

- Emotional trading: letting emotions drive your decisions instead of sticking to a strategy

Avoiding these pitfalls can help ensure a more successful investment journey in cannabis stocks.

My Only Cannabis Investment

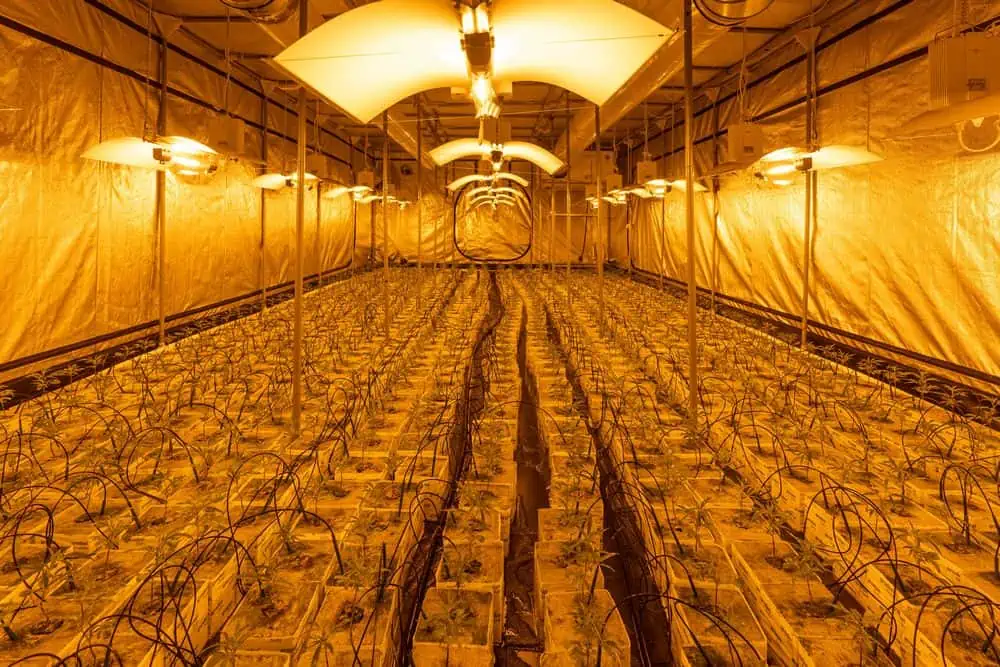

The business I have invested in is called Innovative Industrial Properties Inc (IIPR). It is a REIT (real-estate investment trust) that specializes in properties used for cannabis-related businesses.

It is down about 30% from when I bought it. As a REIT, it pays a dividend (quite a high dividend at the moment), so I will not sell it. It pays me my dividends every quarter, while I wait for the price to go back up.

And I do expect it to increase again, because the primary reason it fell was that some tenants were having a difficult time paying their rent to IIPR (how the business makes income) and high interest rates are making it hard on the business to fund additional investments.

As interest rates come down, the stock price should improve. Of course, there is always the risk that more tenants get into financial trouble, which would further hurt IIPR.

Bottom line: any cannabis company is a risky investment, even a REIT, which is generally safer than other stocks. Do your due diligence before you invest in this business, or any other.

Cannabis Investments: Final Thoughts

Investing in the cannabis industry offers both significant opportunities and unique challenges. It’s crucial to start with thorough research, understanding your own investment goals and risk tolerance.

The cannabis market is volatile, influenced by legal and regulatory changes, and can attract both legitimate businesses and potential scams. Diversification, careful selection of companies, and staying informed about industry trends are essential strategies for mitigating risks.

By starting small, monitoring industry dynamics, and networking with trusted individuals, you can make more informed decisions. Avoid common investment pitfalls such as over-concentration and emotional trading.

Remember, the key to successful investing is a long-term perspective and disciplined approach. While the cannabis industry holds promise, it requires careful consideration and due diligence to navigate effectively.

Leave a Reply